Welcome to the 6 people who have joined us since the last essay! Join other smart, curious folks by subscribing here.

Hi friends 👋🏻,

Welcome to another essay on Open Africa.

After the record-breaking year that was 2021 with multiple unicorns minted, it seemed like everyone was on a high with fist-bumping and happiness. But 2022 kicked off and all of a sudden investors and operators realised that they were signing more cheques than they used to, investing at higher valuations and prices.

Didn't they see it coming?

In the last month alone, there have been multiple zoom sessions, Twitter spaces hosted, articles are written and tweetstorms with questions asking

Is the African tech ecosystem in our own bubble? Are prices higher today? Heck, shouldn’t startup valuations be lower?

At the end of the day, startups are valued based on how much they can deliver in the future. Of course, VCs know what they're getting themselves into. They're not a charity or looking to invest in companies that grow slowly, and generate enough cash flows to pay dividends. That's not the business. Most of the money invested today is for outcomes that could be an IPO or an acquisition.

Not many companies get to this stage and the common reason for this is because of the prevailing macro conditions (read: market size). As we'll see in this essay, that's one part of the argument but not all markets are made equal.

To understand this, we'll go through:

False Positives?

The Only Thing That Matters

Emeka and the Hierarchy of Venture Opportunities

Case study: Jumia and Flutterwave.

A Bubble of Optimism.

False Positives?

2021 was Africa's coming of age moment. Even though Paystack was acquired by Stripe in 2020 and Jumia went public the year before, the momentum in 2021 blew those achievements out of the water. Here are some of the highlights I shared in a previous essay:

More unicorns were minted in 2021 than in the prior years combined. A whole five - Chipper cash, Flutterwave, Wave, OPay and Andela.

We raised a record $4.65 billion in disclosed funding.

More businesses were funded- 564 up 42% from 2020.

The record for the largest single round was broken on more than 5 occasions with Flutterwave, TradeDepot, Gro Intelligence, Chipper Cash and Yoco all taking shots.

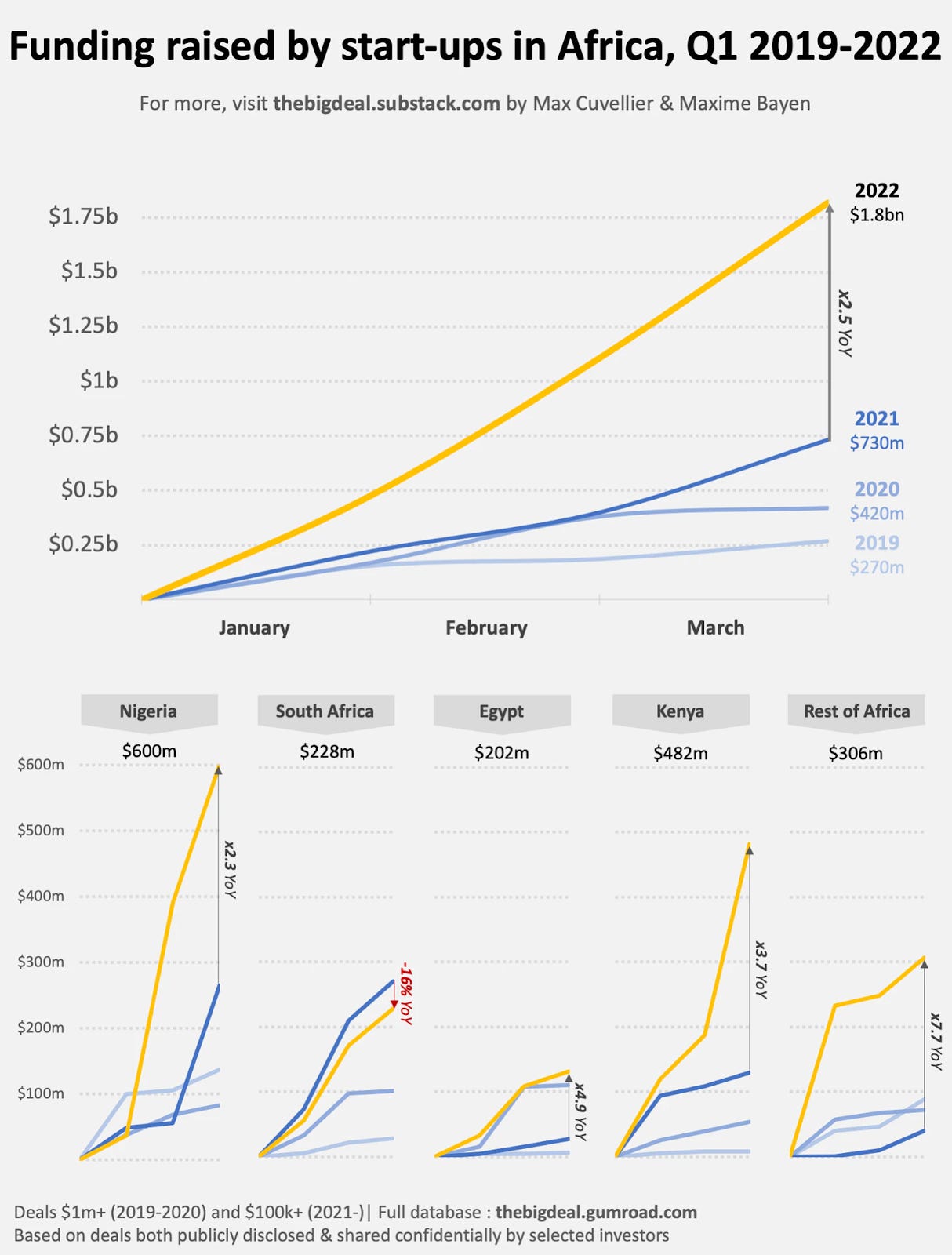

That momentum has continued into 2022 with $1.8Bn already raised in Q1, which is about 38% of what was raised in 2021.

If this funding rate continues to accelerate, we could see total Africa funding possibly exceeding $7Bn. This should be exciting, right? Well, not many are sharing the same optimism. Despite the young and fastest-growing population story, the argument has always been that the value of a company should be steeped in the size of the market.

It’s not only founders that look at markets but also the VCs that invest in them. Even Marc Andreessen of a16z, says the same. According to him, the success of a startup depends on the market, more than the quality of the team or the product. The size and growth of the market remain king.VCs are looking at large markets which will lead to high returns. This is the reason why some verticals are more valuable than others. In Africa, fintech receives much more love than say logistics or eCommerce.

Big markets should attract high valuations, right? Probably. But what is it about the African market that makes operators suggest that this may be a bubble? Dr Ola Brown helps us with this.

The Only Thing That Matters

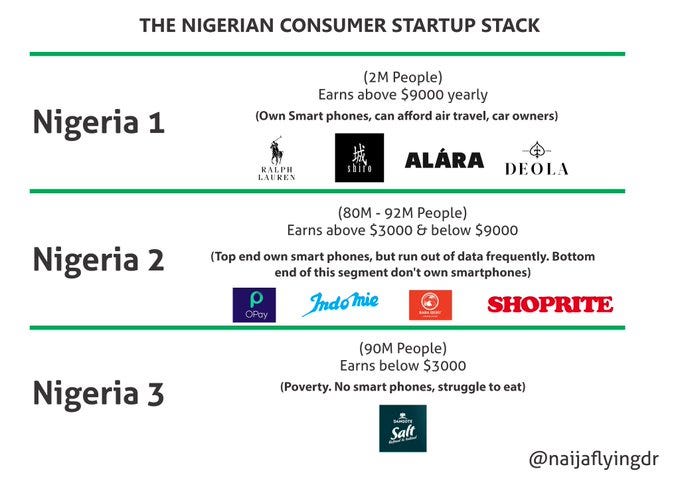

In 2019, Dr Ola Brown of the Flying Doctors released an outstanding work on the market size for tech businesses in Nigeria. In it she divided the market into three different segments based on their purchasing power and annual income namely:

Nigeria I - made up of 2m people earning an annual income of $10,000

Nigeria II - made up of 80–92m earning an annual income between $3000 - $9000

Nigeria III - made up of 90million people earning below $3000

Each of these segments has different wants, needs and purchasing power. Someone in Nigeria I can afford to travel frequently and has high taste in premium products. Those in Nigeria II use services like Jumia and Uber occasionally. While the rest in Nigeria III live in extreme poverty and can only afford products for daily survival like salt.

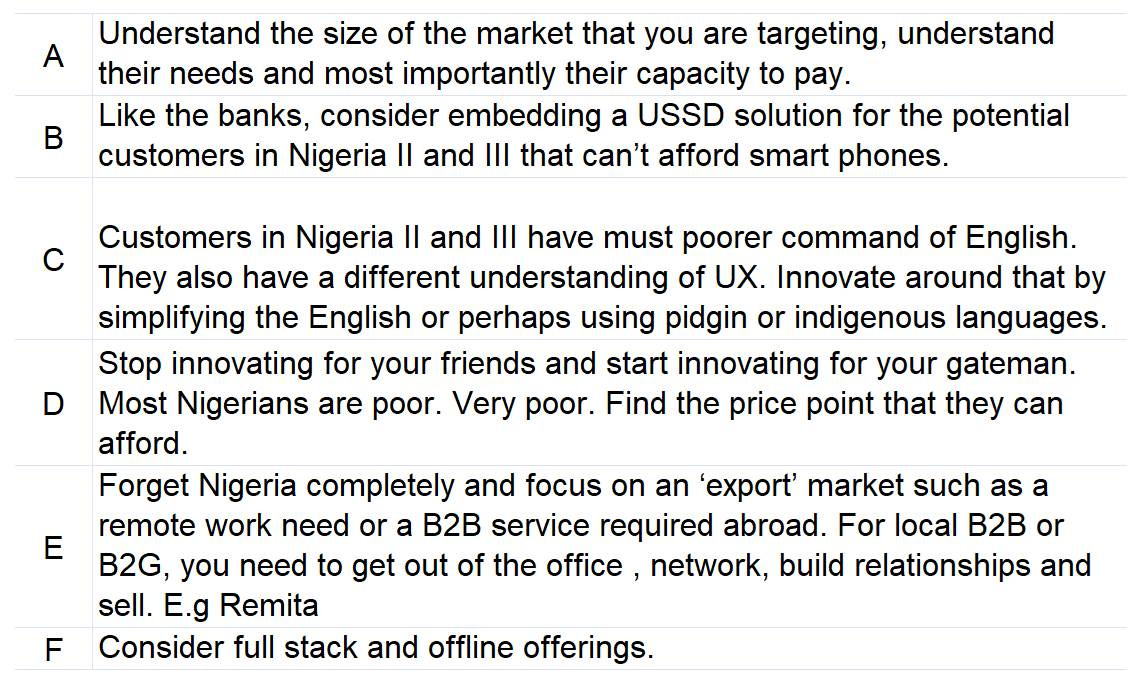

She ends the article by advising startups to focus on understanding the local context of the Nigerian market, create offline solutions and expand out of Nigeria as a means to achieve scale across all three segments.

In a lot of ways, the article did a lot in showing how difficult it is to scale in Nigeria. However, most of the advice seemed relevant to B2C or Consumer apps. These are businesses whose customers can be cleanly split into the different segments described above. They have to innovate around the UI/UX of apps or provide cheap or heavily discount products to acquire users. For this group, her advice is key!

But today, most of the investment dollars are going towards the B2B startups who make up 48% of Nigeria’s GDP. They are different from Consumer startups creating opportunities for everyone to win in the long run.

Emeka and The Hierarchy of Venture Opportunities

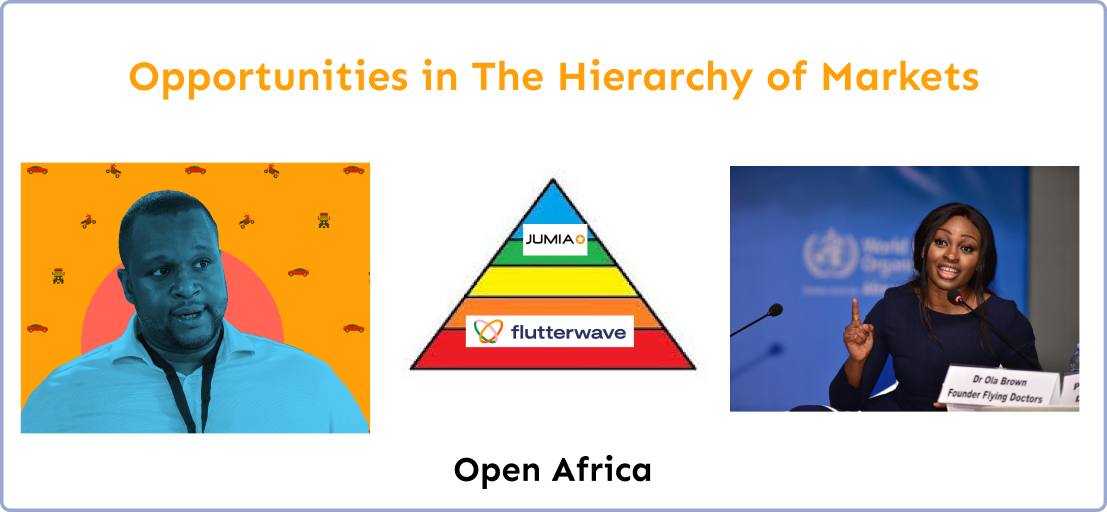

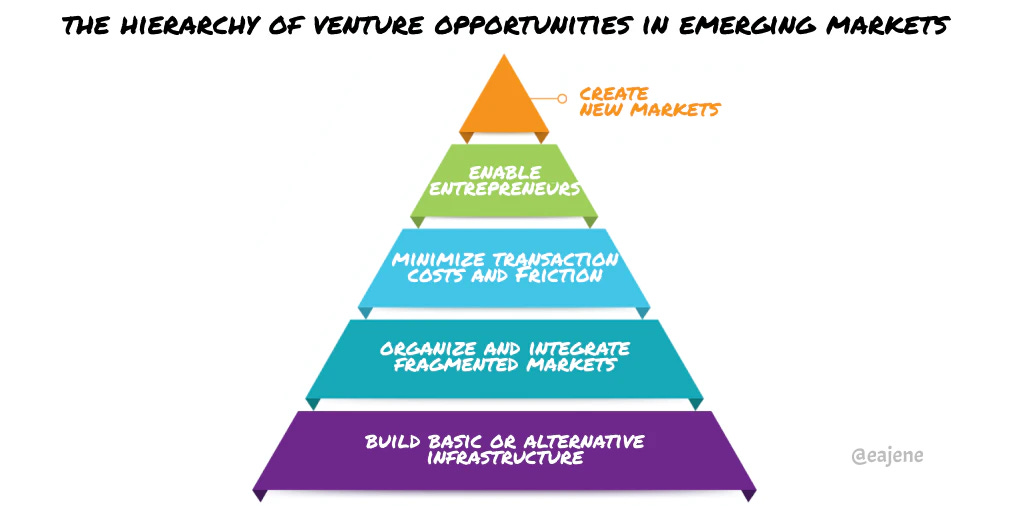

Nine months after Dr Ola released her article, Emeka Ajene, Gozem Co-founder and Curator-in-Chief at Afridigest, released his article titled “The Hierarchy of Venture Opportunities in Emerging Markets”. In it, Emeka used Maslow’s hierarchy of needs to find underappreciated trends and opportunities to create businesses.

According to Abraham Maslow, people’s behaviours and choices are based on satisfying some unmet needs. These needs could be physiological, safety, the need for belonging/love, esteem or the need for self-actualisation.

But what are the motivations for markets?

Emeka came up with a framework called “The Hierarchy of Venture Opportunities” to identify opportunities based on market needs and their relative attractiveness.

Following Maslow's original hierarchy, Emeka’s five-step pyramid suggests that a set of basic needs must be met first before going up the ladder to tackle higher-order, more complex ones.

At the end of the article, Emeka remarked that his framework shouldn’t be seen as a ranking of opportunities but as a starting point for problem identification.

Going from Level 1 to Level 3, you may observe that businesses here aren’t Consumer startups but are B2B services like Flutterwave, Kobo360, Norebase, Andela etc providing “Layer 1” services, building basic infrastructure and organising fragmented markets that others can plug into easily.

All markets are not equal and it is this context I believe Dr Ola’s article missed in assessing the Nigerian market. Foundations must be built first before going to the mass market. 200m Nigerians is not a market for anybody.

Moving away from theory, the wave of innovation and software development didn’t always start with B2B services but with Consumer startups.

In the early days of the internet, commerce was among its first use cases in the US with Consumer startups like Amazon and eBay founded around the time. This wasn’t unique to the US. In China, early internet companies were messaging services like QQ, social media platforms like Weibo or e-commerce companies like Alibaba.

These were all companies selling products and services to consumers who were the end-users of their products or services.

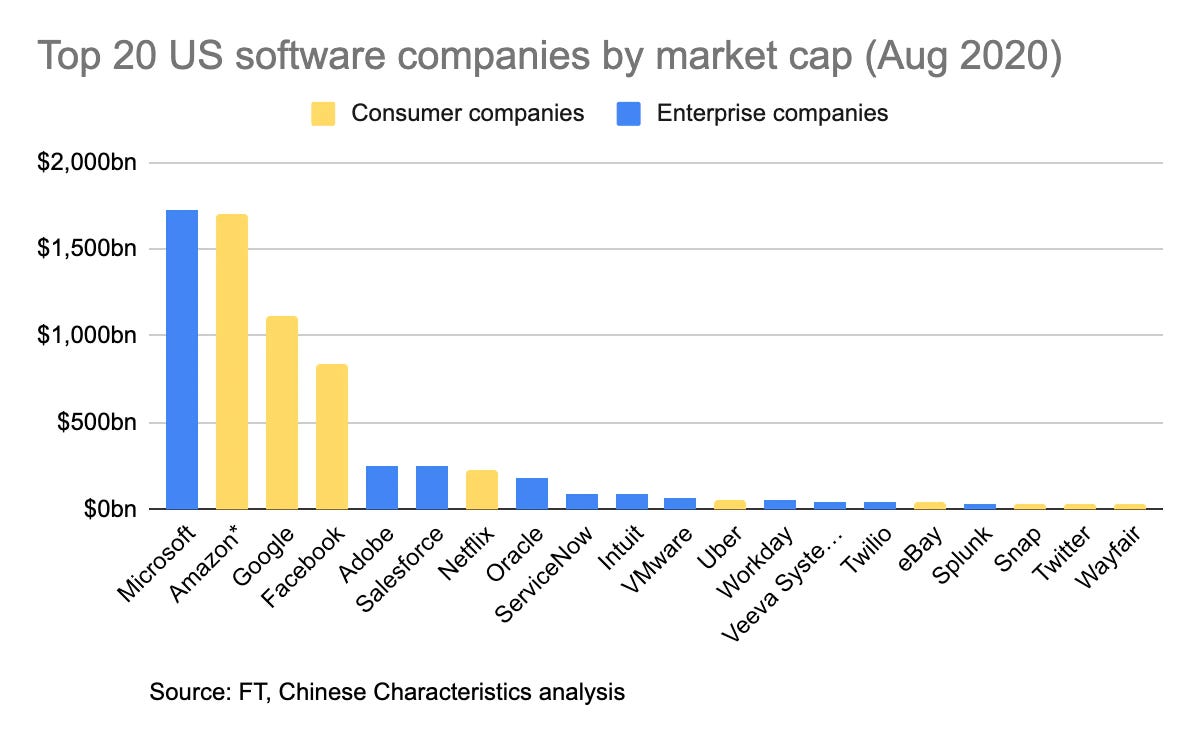

But after some time, B2B/Enterprise companies sprung up and today form the most capitalised companies in the US. Of the 20 biggest US tech companies (excluding hardware) enterprise companies accounted for 55% by count in 2020.

So in the west, Consumer startups came before B2B startups but in Nigeria, it’s the other way around with B2B startups forming the backbone for which Consumer startups can thrive. Of the companies that have raised the most money, a high percentage of them are B2B services; TradeDepot, Interswitch, Paystack, Flutterwave, Andela, Kobo360 etc.

Industry veteran, Emeka Okoye probably observed this in 2016 saying that “B2C transactions are not what elevates the technology status of a country, it’s the B2B”.

Side note: I use B2B and Infrastructure definitions interchangeably, so just follow me with this for now.

But that was in 2016 and things have changed. Our ecosystem is being built by B2B companies powering technology and they are shaping the future of what is possible in a way that makes higher-level needs of B2C companies easier to solve. I think there are a couple of reasons for this:

Value chain optimisation

Compounding products

Value chain optimisation

Before a product gets into the hands of a consumer, there are several steps it takes in the process. In his book titled “Competitive advantage”, Michael Porter asserts that optimising the processes that help companies deliver value (e.g a product or service) gives them a competitive advantage. In an economy where 48% of it is supported by SMEs, using better B2B services helps them deliver products to end-users in a cheaper and faster way in a way that sustains profits.

Compounding Products

Starting a company today is much easier than it was in 2010. At the first level of The Hierarchy of Venture Opportunities, startups are building basic infrastructure that other companies can use.

It’s like APIs giving companies superpowers so they can focus on their value proposition.

As I described in the API essay, B2B services let other companies focus on their value proposition instead of reinventing the wheel. Sure, not all B2B companies have the “API-characteristic”, but those that do are used as legos plugging into each other to make it easier to build customer-facing apps.

An example of this is excellently described by Samora Kariuki of Frontiers Fintech. To build a business like Chipper Cash, one only has to:

...get licensing in each market, partner with someone for identity verification, open bank accounts for the store of value and negotiate exchange rates for settlements...partner with a player such as Flutterwave for centralised liquidity management, reporting for some payment types and payments and collections for some markets.

A business like Chipper Cash wouldn’t exist today without those core infrastructure products. Building basic infrastructure, organizing and integrating fragmented markets in a way that minimizes transaction costs means that it is much easier for a young consumer fintech like Chipper Cash to become a unicorn in just 3 years.

A good way to understand this better is by observing two companies in different industries at different levels of the Hierarchy.

Case study: Jumia and Flutterwave.

Some people might say comparing Jumia and Flutterwave is a case of apples and oranges. That’s true, but it helps us identify and understand B2B and B2C companies at different stages of the Hierarchy and what it takes to win.

Jumia.

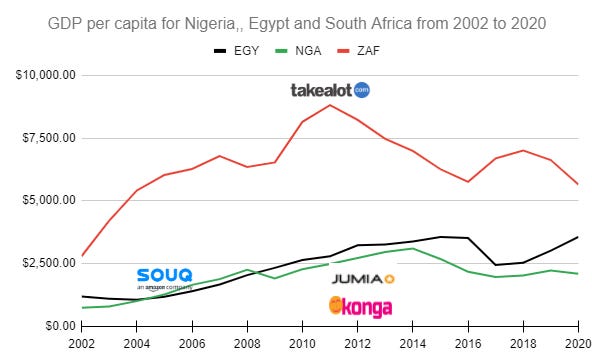

When the Nigeria tech ecosystem began to kick off between 2010 and 2012, it seemed like eCommerce was the first use case. Well, why not? E-Commerce companies like Souq was founded in 2005. Take2 was founded in 2002 before it was acquired and renamed Takealot in 2011. Konga was founded in 2011.

So it only made sense for investors to see Jumia as a natural extension of this trend.

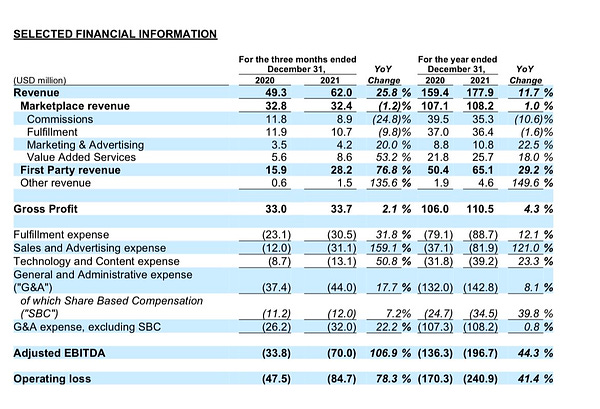

But, after raising $1.2Bn and then going public in 2019 on the New York stock exchange (the first African startup to do this), Jumia just never lived up to the expectations. Its share price has dropped more than 60% and currently trades at $8.74. At the current price, its market cap is $783.36m, 47% lower than the total funding it raised as a private company.

Maybe this was not of its own doing but it seemed like Jumia was a story that was too early for the Nigerian market. Using Dr Ola’s analysis, macroeconomic issues could be seen as some of the reasons for its “failures”.

Jumia’s customers were occasional shoppers with low disposable income. They were among the lower tier I and tier II customer segment earning between $3000 and $9000. For this segment, selling and delivering products like toiletries, and provisions within two days or the same day (for an extra fee) was always going to be tough.

Anything Jumia sold to Nigerians always competed with food prices.

But using the hierarchy of markets framework, Jumia sits high in the pyramid between the layers of “Enable entrepreneurship & economic empowerment” and “Creating New Markets”. Jumia is a company that enabled improved economic outcomes for merchants while attempting to create new customer behaviours through online retail.

They wanted to be the Amazon of Africa but Amazon is quite different for certain reasons:

Amazon was built on top of the existing logistics infrastructure of UPS and FedEx and as a result, could use its scale advantage to offer low-cost products to customers

The GDP per capita in the US at its IPO in 1997 was $31,459.14, 15x more than it is today in Nigeria in 2022 ($2097.09)

Amazon was already a global company at the time of its IPO.

As the hierarchy suggests, building products at the lower levels makes it easier to build those higher up the pyramid. Jumia started at a time when fundamental building blocks were not available and so had to build those to support its operations. It built its own logistics network, and payments provider and is now even becoming an advertising company.

Doing all these doesn’t come cheap. Jumia remains a loss-making venture shutting down operations in multiple countries to manage burn.

Whether this form of vertical integration can give it compounding advantages in the long term is up for speculation.

But as Jason Njoku says, nothing beats getting the unit economics right before scaling.

Flutterwave

If you have been following the African tech landscape, you’ve probably noticed the cycles. The first cycle was dominated by eCommerce companies as we described earlier. That lasted for almost a decade before giving way to a new one.

That’s the thing about cycles. They rise and they fall.

Today’s cycle is led by fintech companies championed by the likes of Fawry, Paystack, MFS Africa, Chipper Cash etc but it “feels” like the company leading the charge is Flutterwave. Flutterwave was the first company I wrote about on Open Africa.

But the idea that a B2B service is fundamental to creating and supporting consumer apps was not one I had conceived before.

For a business like Flutterwave, here’s how they may have exploited the Hierarchy of Venture Opportunities:

Levels 1 and 2, about infrastructure, were solved with their Payments product;

Levels 3 and 4, about reducing friction for entrepreneurship, were solved with the Commerce product that allows merchants to create an e-commerce store.

Level 5, creating new markets, as described by Emeka is very rare and poorly understood. Still, Flutterwave might claim to have reached this summit with their new array of products including capital and card issuing that’s turning startups into just features.

With Flutterwave, more businesses have Endless Possibilities all the way up as their impact continues to compound!

A Bubble of Optimism

So are we in a bubble? Maybe. The purpose of this article wasn’t to give a binary answer as to whether we are or not. If you want an answer to that, you may look to Nichole Dunne of Founders Factory who presents a case that we aren’t in a bubble.

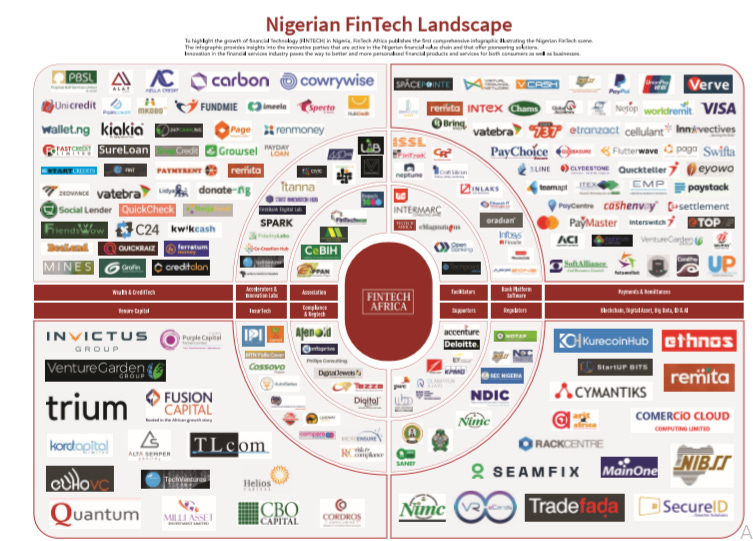

To be honest, I believe some startups are more “bubbly” than others. There are at least 250 fintechs in Nigeria. With only Paystack as the “only” exit, this number is TOO DAMN HIGH!!!

Maya of Ingressive capital was just as amazed by this saying:

There are consumer fintechs with talk of “over $500m valuations, and I don’t know anyone who uses the product. (p.s: if you know what companies she was referring to please DM :)

It’d be arrogant to believe that markets and prices will continue to go up without any correction. It would also be arrogant to suggest that this essay answers the bubble question by saying all B2B companies are going to win their markets.

I believe the Hierarchy of Venture Opportunities gives us a good guide for where opportunities exist and should be exploited. But apart from it, operators should also consider the following as they scrutinize valuations:

Are there enough local businesses that could be disrupted by new technology or startup?

How close are valuations to the exact market size?

What happens once there’s no longer dry powder? Are the unit economics resilient enough on the path to profitability? It took Paga 11 years before expanding to new markets. There is a balancing effort to win markets and it involves balancing customer acquisition with retention. Getting customers is a function of market need, retaining customers is a product need. Does the business know where it stands?

In my one year stint in VC, I have observed that economic growth and development rarely follow a straight line. Jumia and the many eCommerce companies that existed in the 2010s struggled but through this, other businesses discovered problems that should be solved first before moving up the hierarchy. Some may even go ahead to argue that there was an eCommerce bubble during this time.

Even if our ecosystem is in a bubble that bursts, it can be good for two reasons:

An African tech bubble wouldn’t cause global ripple effects like the dot-com bubble. African investment was only about 4% of US investments in 2021. Local investors and the 3-5th market leaders may be burnt. This will be tough but it means that more consolidation will happen.

As more later-stage companies grow and hopefully exit, we can assess what business models work and who the eventual winners are. It will also make everyone perceive Africa as a real market that needs well-informed capital and support.

I believe that good things should be expensive because that gives value to their intrinsic worth.

Concluding in the words of David Cowan in the context of today:

A crash can be crucial in shaking systems, forcing investors and founders to return to the fundamentals. A possible technology crash might be the signal that the whole continent has become a real investment destination of sufficient size to attract increased global economic attention and with the potential to have a massive impact in the future.

If you enjoyed this piece, please like and share it with your friends, bosses, journalists, co-workers and anyone else that could benefit from it.

Also, If you’re an early-stage startup in Africa that wants to share your story, I’d love to chat about what you’re working on. You can send me a mail or send a DM.

What did you love about today's essay? Please let me know in the comments. Your feedback helps me make this great. Good, Meh, Great?

Thanks for reading and see you soon.

Kamso.

Share this post